Feb 17 2012

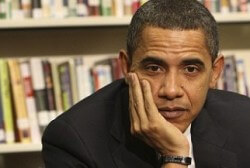

Incompetence-In-Chief

OK, the only thing I get out of this story (besides heart burn that my family is going $70K in debt simply because Obama is in office) is to wonder how incompetent you have to be to not control your spending, so you avoid looking to the entire world like you can’t control your spending:

“Following the contentious debt ceiling last August, President Obama promised that he would take action to address the country’s fiscal crisis. He has failed to do that,” Portman said. “In fact, his new budget increases spending and projects that Washington will be hitting the debt ceiling again in mid-October – burning through a $2.1 trillion debt limit increase in just over 14 months.”

Good Lord. Handed $2.1 trillion dollars the Incompetence-In-Chief and his Senate Democrat brethren still couldn’t make it past this next election. Not to mention how dumb the GOP looks for giving the guy the money to blow in the first place.

Is there any clearer sign DC is broken?

Incompetent by our general standards but some would also say he could be considered to be progressing exactly as planned towards his desired end game.

GEITHNER: You could have taken [the chart] out [to the year] 3000 or to 4000. [Laughs]

RYAN: Yeah, right. We cut it off at the end of the century because the economy, according to the CBO, shuts down in 2027 on this path.

MerlinOS2, you are absolutely correct. But his plan is not going to prevail. His incompetence has to be measured by a different standard. He is competent in his vision to destroy America. His incompetence appears to be more in the area of reality, of what is good for the country. I’m quite sure Hitler thought he had the ideal plan for his country and that he was 100% competent in attempting to achieve it. His downfall was in not recognizing that it was not what the world was ready for or was willing to permit.

This is clearly a battle between good and evil. evil will not prevail.

And somehow, I’m sure, this is Romney’s fault…

There is one reason for optimism about all this debt: it has now gotten so big that everyone knows we will never pay it. We’re either going to inflate the currency so much that the debt will all be worthless, or else we’re going to default on it. I imagine we’ll do a bit of one and a bit of the other.

Of course this means that all your pensions and social security and savings are worthless jokes, but hey, that’s about as far as optimism gets you these days.

Lesson: do what the country is doing. Blow everything and live large today, because there is no tomorrow. Obama is just giving us what we as a people collectively want – and we deserve to get it, good and hard.

Remember, 51% of the families in this country now receive some kind of government payout. We’re past the point of no return.

Mrs Obama goes to Vail with the children for an extended weekend of skiing. Lift tickets for one day, $165 for one adult, children $10 cheeper. Please don’t lecture me about fair, equal, middle class, brother’s keeper, we are all in this together. You took my share and used it to lift yourself up the mountain!

Change Vail to Aspen, both are equally expensive.

wws, do we know how many of the 51% are people collecting their social security payments?

If rick santorum doesn’t stop talking about abortion, women, etc he will be responsible for a whole lot of bad for the republican party, imho.

ivehadit, there is a worse 51% number than the benefits received; and that is the fact that 51% of Americans now pay *no* income tax at all. Think about it for a bit; that means that now 51% of Americans will *always* support raising the income tax because that, of course, means taxing someone else, not them. This is Obama’s constituency. This is why he can promise to raise income taxes while counting on 51% support. He’s got it.

(and it takes too much thought to realize that raising taxes might hurt the jobs they depend on – but of course the Feds can just print money and hand it out to them when they’re unemployed, can’t they?)

Here’s a comprehensive report on current government dependance. I couldn’t find the exact SS number you were asking for, but their numbers show that recipients of SS are increasing dramatically each year as the “baby boomers” retire.

http://www.heritage.org/research/reports/2012/02/2012-index-of-dependence-on-government

They also point out the deepest and most hidden tragedy of the SS system: since SS taxes are high for middle and lower working class Americans, they make it very difficult for those workers to accumulate significant retirement savings of their own, while at the same time telling them they don’t have to since the Government is doing it for them. Since SS has far overpromised what it can pay, and since it has no actual “lockbox” and is instead funded out of current receipts, the system is heading quickly for an inevitable crash.n (Stunts like the recent payroll tax holiday bring the crash closer every day)

SINCE very few now have the inclination or the ability to save for their own retirement, as a matter of public policy, then the SS crash, when it comes, is going to wipe out the holdings of the vast majority of working Americans just as it has in Greece. There’s no question of avoiding this any more, it’s far too late in the game for that – the only question is how long we can keep the Show going before everyone finally sees the rot underneath.

The absolute, unequivocal tragedy is this:Have you ever run the numbers on what your ss contributions would have been worth over the past 40 years invested mostly in the S&P 500 with 20% bonds, with the compounding of interest/growth being applied? (of course this ratio would change the closer to retirement one becomes)

For example: if you had $4500 per year paid into ss (includes your employer earning 10% per year for 40 years), guess how much your ss fund would be worth? $2,391,292.59. TWO MILLION DOLLARS. You know how much you could withdraw from this AND STILL LEAVE MONEY FOR YOUR HEIRS? Earning 4% per year and dying at age 90, appx $12,427.62/month leaving $100,000 to heirs.

wws, so the 401K by itself is no longer recommended because it’s going to be useless? Many people have company provided 401K programs with their companies contributing to them. In the meantime, they ain’t saving on their own either.

Do you anticipate another stock market crash within the next two years?

It seems that the majority ain’t seeing the rot underneath yet.

BTW, it’s interesting to watch the left react to Dana Loesch when she challenged them on Obama’s contraceptive law versus VA’s sonogram law.

And I’m amused that Texas hasn’t been mentioned.

Second paragraph above should read (includes your employer) earning 10% per year for 40 years

Lurker, unlike many I’ve come to believe that there will *not* be a general stock crash in the next couple of years, but not because economic matters will get any better. Remember the “PPT”, the Plunge Protection Team? If stock prices start looking like they are breaking down, the Fed will pump in $10 billion, $100 billion, even a Trillion just to keep prices up and things looking good. Where will they get it? Why, they’ll just create it out of thin air.

Okay, the real dirty little secret is that they’ve been doing this pretty consistently for the last 3 years already. Fed pumps money into the banking system at zero % interest, and it flows from the banking system into the big trading houses like Goldman and JP Morgan, and through them to the Hedge Funds, and finally into the market. That’s where all this created money is going – not to create jobs or help workers, but just to keep the whole financial carnival going.

So can this just go on? Of course not. Sooner or later this always leads to hyperinflation – watch your commodity prices, especially gold, oil, and gasoline. They will soar because so much money is being pumped into the system – and the only answer will be to pump even more money into the system. Death spiral.

Stock prices will probably keep going up – but that won’t do much good when sliced bread costs $100 a loaf.

Oh my gosh…the Black Swan.

Thanks for your insightful post.

Goldman Sachs is the designated player to run the PPT.

Now when they are acting in that capacity they get to view the order books of all the large players in the markets.

Like playing poker with all the hands place down on the table for them to see.

As the fed keeps printing money that keeps lowering the value of our dollar. Only the EU crisis is holding it up in the markets right now.

China just loves getting paid back in cheaper dollars.

check out WUWT – best story of the year so far getting chronicled over there! Another global warming fraudster just got caught with his pants down!

What is WUWT?

I see that Europe kicked the can down the road for Greece. I read yesterday that USA did not want Greece to fail. USA didn’t want a country to fail? Add that to the “too big to fail” list?

“Watts Up With That”, the best Science blog on the net, by far! AJ recently was granted a guest post their (congrats, btw! quite an honor!) and the link to it is at the bottom of AJ’s alphabetical Blogroll in the sidebar of this page.